ANUALIDAD

-Cantidad de dinero igual

-En periodos y tiempos iguales

-No tiene que incluir forzosamente en plazo de tiempo anuales

AMORTIZACIÓN

-Es la cantidad de dinero que salda gradualmente una deuda

-Considerando los intereses que genera dicha deuda

-Respetando los plazos de tiempo estipulados

ejemplo:

Institucion

capital: 463200

tasa de interes : 39% anual

tiempo: 5 años

tiempo 30 bimestres

interes: 0.058333333

| ALTERNATIVA 2 | fecha de pago | anualidad | interes | amortizacion | saldos | 0.05833333 | 463200 | |

| 1 | 26/12/2015 | $33,053.06 | $27,020.00 | $6,033.06 | $457,166.94 | |||

| 2 | 26/02/2016 | $33,053.06 | $26,668.07 | $6,384.98 | $450,781.96 | |||

| 3 | 26/04/2016 | $33,053.06 | $26,295.61 | $6,757.44 | $444,024.52 | |||

| 4 | 26/06/2016 | $33,053.06 | $25,901.43 | $7,151.63 | $436,872.89 | |||

| 5 | 26/08/2016 | $33,053.06 | $25,484.25 | $7,568.80 | $429,304.09 | |||

| 6 | 26/10/2016 | $33,053.06 | $25,042.74 | $8,010.32 | $421,293.77 | |||

| 7 | 26/12/2016 | $33,053.06 | $24,575.47 | $8,477.59 | $412,816.18 | |||

| 8 | 26/02/2017 | $33,053.06 | $24,080.94 | $8,972.11 | $403,844.07 | |||

| 9 | 26/04/2017 | $33,053.06 | $23,557.57 | $9,495.49 | $394,348.58 | |||

| 10 | 26/06/2017 | $33,053.06 | $23,003.67 | $10,049.39 | $384,299.19 | |||

| 11 | 26/08/2017 | $33,053.06 | $22,417.45 | $10,635.60 | $373,663.59 | |||

| 12 | 26/10/2017 | $33,053.06 | $21,797.04 | $11,256.01 | $362,407.58 | |||

| 13 | 26/12/2017 | $33,053.06 | $21,140.44 | $11,912.61 | $350,494.96 | |||

| 14 | 26/02/2018 | $33,053.06 | $20,445.54 | $12,607.52 | $337,887.45 | |||

| 15 | 26/04/2018 | $33,053.06 | $19,710.10 | $13,342.96 | $324,544.49 | |||

| 16 | 26/06/2018 | $33,053.06 | $18,931.76 | $14,121.29 | $310,423.20 | |||

| 17 | 26/08/2018 | $33,053.06 | $18,108.02 | $14,945.04 | $295,478.16 | |||

| 18 | 26/10/2018 | $33,053.06 | $17,236.23 | $15,816.83 | $279,661.33 | |||

| 19 | 26/12/2018 | $33,053.06 | $16,313.58 | $16,739.48 | $262,921.85 | |||

| 20 | 26/02/2019 | $33,053.06 | $15,337.11 | $17,715.95 | $245,205.90 | |||

| 21 | 26/04/2019 | $33,053.06 | $14,303.68 | $18,749.38 | $226,456.52 | |||

| 22 | 26/06/2019 | $33,053.06 | $13,209.96 | $19,843.09 | $206,613.43 | |||

| 23 | 26/08/2019 | $33,053.06 | $12,052.45 | $21,000.61 | $185,612.82 | |||

| 24 | 26/10/2019 | $33,053.06 | $10,827.41 | $22,225.64 | $163,387.18 | |||

| 25 | 26/12/2019 | $33,053.06 | $9,530.92 | $23,522.14 | $139,865.05 | |||

| 26 | 26/02/2020 | $33,053.06 | $8,158.79 | $24,894.26 | $114,970.78 | |||

| 27 | 26/04/2020 | $33,053.06 | $6,706.63 | $26,346.43 | $88,624.36 | |||

| 28 | 26/06/2020 | $33,053.06 | $5,169.75 | $27,883.30 | $60,741.05 | |||

| 29 | 26/08/2020 | $33,053.06 | $3,543.23 | $29,509.83 | $31,231.23 | |||

| 30 | 26/10/2020 | $33,053.06 | $1,821.82 | $31,231.23 | - 0.01 |

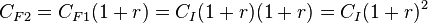

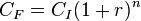

es el capital al final del enésimo período

es el capital al final del enésimo período es el capital inicial

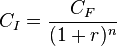

es el capital inicial es la tasa de interés expresada en tanto por uno (v.g., 4 % = 0,04)

es la tasa de interés expresada en tanto por uno (v.g., 4 % = 0,04) es el número de períodos

es el número de períodos

es la tasa de interés total expresada en tanto por uno (v.g., 1,85 = 185 %)

es la tasa de interés total expresada en tanto por uno (v.g., 1,85 = 185 %) , así el capital final actualizado al tiempo t viene dado por:

, así el capital final actualizado al tiempo t viene dado por:

![r = \left( {\frac{C_F} {C_I}}\right)^{\frac{1} { n}}- 1= \sqrt[n]{\frac{C_F} {C_I} }- 1](https://upload.wikimedia.org/math/5/e/1/5e18417e6346aac505bcaf963c050be1.png)